Indian cricket legend Sachin Tendulkar, the family offices of Marico’s Harsh Mariwala, Manipal Group’s Ranjan Pai and Fireside Ventures founder Kanwaljit Singh, who bought shares in e-commerce unicorn FirstCry last year will be sitting on a loss of up to 10 percent at the company’s initial public offering (IPO). However, the above-mentioned investors are not selling their shareholding in the IPO.

The unrealised loss is because the price band for the company’s IPO has been set at Rs 440-Rs 465 apiece, lower than their buying price of Rs 487.44 per share.

Among the big winners in the IPO is former Tata Sons chairman Ratan Tata who holds 77,900 shares in FirstCry which were bought at an average price of Rs 84.72. He is listed as a selling shareholder in the company’s filings for the IPO and is sitting on more than 5X gains on the basis of the offer’s price band.

Mahindra & Mahindra Limited, which owns 11 percent of FirstCry will also be a big gainer, with an almost 6X jump in the value of its holdings. Its average price of acquisition of FirstCry shares was Rs 77.96 apiece.

Most investors in the company — whether selling in the IPO or not — are likely to be sitting on gains, except for the shares bought in a round last year when shareholders like SoftBank and FirstCry founder Supam Maheshwari sold a part of their holdings.

Maheshwari, who currently holds about 5.95 percent stake in the company, sold shares worth Rs 300 crore in the pre-IPO round in 2023.

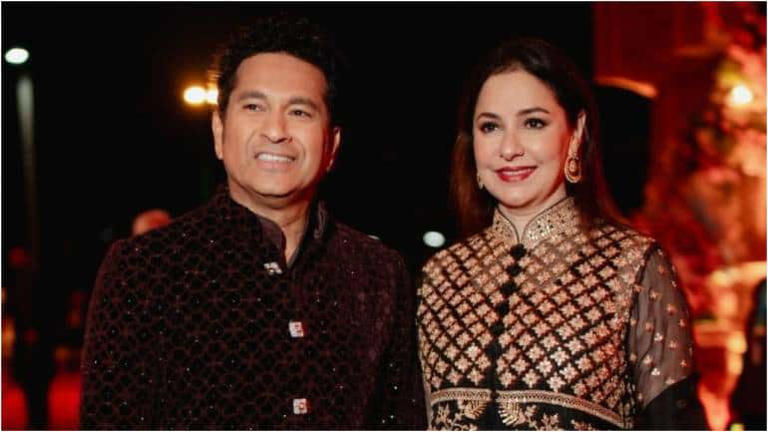

That’s when Tendulkar and his wife, Anjali, bought over 2 lakh shares in FirstCry, Mariwala’s family office Sharrp Ventures bought 20.5 lakh shares, Ranjan Pai’s family office bought 51.3 lakh shares, Kanwaljit Singh bought 307,730 shares, Infosys co-founder Kris Gopalakrishnan’s family office bought 615,460 shares, and DSP founder Hemendra Kothari bought 820,614 shares.

Despite the offer price band, some investors in that round in question — such as Premji Invest and Chiratae — are still likely to be sitting on gains as they invested in previous rounds at lower valuations.

For example, one of Premji Invest’s investment vehicles is selling 86 lakh shares in the IPO which were bought at Rs 280.87 apiece, meaning it will register a gain of at least 57 percent. Two funds of the family office of Wipro supremo Azim Premji cumulatively hold a stake of more than 10.3 percent in FirstCry at present.

The IPO consists of a fresh issue of Rs 1,666 crore. At the upper end of the price band, the offer for sale is valued at Rs 2,527.72 crore. The total issue size will be Rs 4,187.72 crore while the total market cap will be Rs 22,475 crore or $2.68 billion.

FirstCry parent BrainBees had first filed draft IPO papers with India’s Securities and Exchange Board of India (Sebi) last December. FirstCry, however, withdrew its draft papers after the capital markets regulator sought more clarity on key performance indicators (KPIs). Sebi had initially sought 25 KPIs of which FirstCry provided only 5-6 in its first set of filings.

When the company refiled its IPO papers, it provided more clarity on its financials. The Pune-based company said that it generated a revenue of Rs 6,480.86 crore in FY24, up 15 percent from Rs 5,632.54 crore in the previous fiscal.

It incurred a loss of Rs 321.51 crore in FY24 versus Rs 486 crore in FY23.